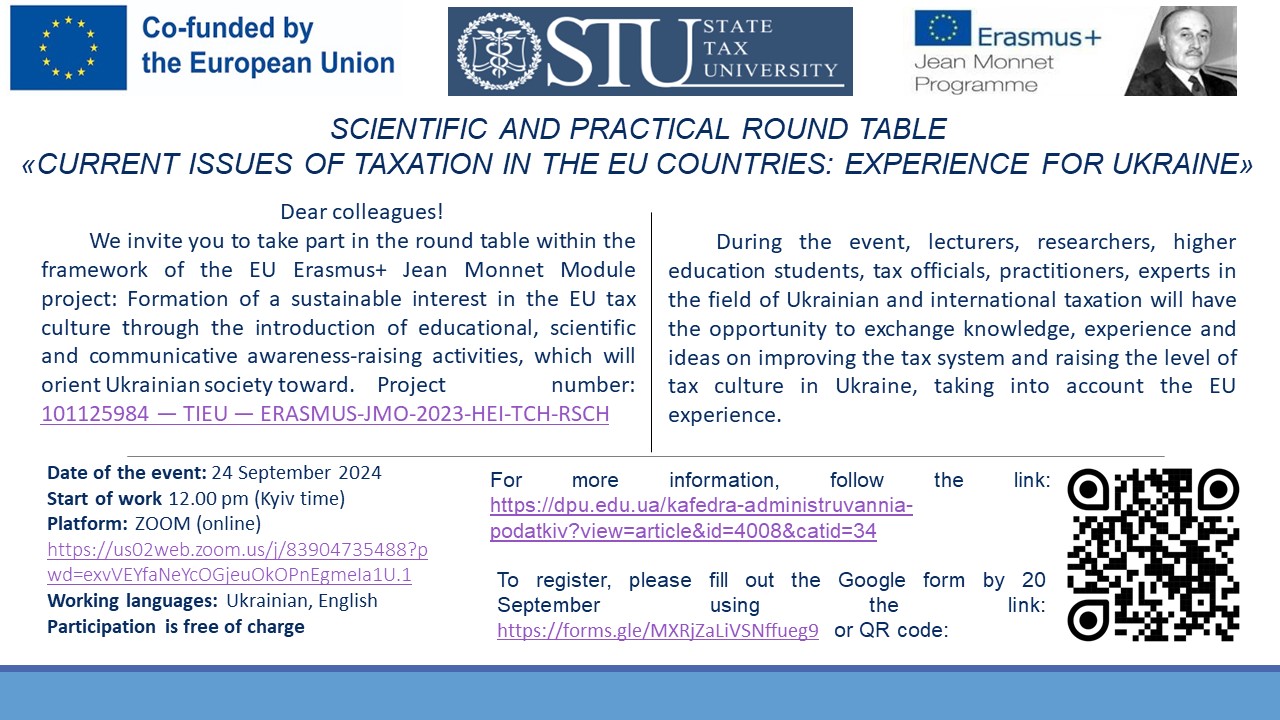

SCIENTIFIC AND PRACTICAL ROUND TABLE

«CURRENT ISSUES OF TAXATION IN THE EU COUNTRIES: EXPERIENCE FOR UKRAINE»

as part of the EU Erasmus+ Jean Monnet Module:

101125984 — TIEU — ERASMUS-JMO-2023-HEI-TCH-RSCH

24 September 2024, Irpin, Kyiv region, Ukraine (12.00 pm Kyiv time)

The purpose of the roundtable is to discuss the current state of taxation in the EU countries with a view to implementing best practices in Ukraine. We invite everyone who is interested in harmonising the taxation system in Ukraine at the EU level and establishing a dialogue in Ukrainian society between taxpayers and public authorities, as well as Erasmus+ project implementers and students who want to share their thoughts on how to ensure that taxpayers are conscious about paying taxes and increase the level of taxpayers' trust in public authorities and governance in Ukraine according to the European model.

The roundtable will focus on the following areas:

- Tax policy and tax harmonisation in the EU.

- Administration of taxes and payments in the EU countries.

- Information services and technologies in the field of taxation and management in the EU countries.

Official languages of the roundtable: Ukrainian, English.

Form of the roundtable: remote on the ZOOM platform via the link.

Participation in the roundtable is free of charge. The organisational and publication costs are covered by the grant project 101125984 - TIEU - ERASMUS-JMO-2023-HEI-TCH-RSCH ‘Building sustainable interest in EU tax culture through the introduction of educational, scientific and communication outreach activities targeted at Ukrainian society’ of the Jean Monnet Programme of the Erasmus+ programme.

To participate in the roundtable, please fill out the registration form by 20 September 2024 at the link and send the abstracts (a .docx file with the name corresponding to the participant's surname, for example, Prokopenko) to the email address

An electronic copy of the collection of abstracts will be sent to the participants and posted in the institutional repository of the State Tax University. Certificates of participation in the roundtable will be sent to all participants by e-mail.

Requirements for abstracts: volume - from 3 to 5 pages inclusive, A-4 format, portrait orientation; all margins - 2 cm; font - Times New Roman, size 12, line spacing - 1.5; paragraph indentation - 1.25 cm; width alignment; abstracts are published in the author's edition; the authors of the abstracts are responsible for the material covered in the abstracts.