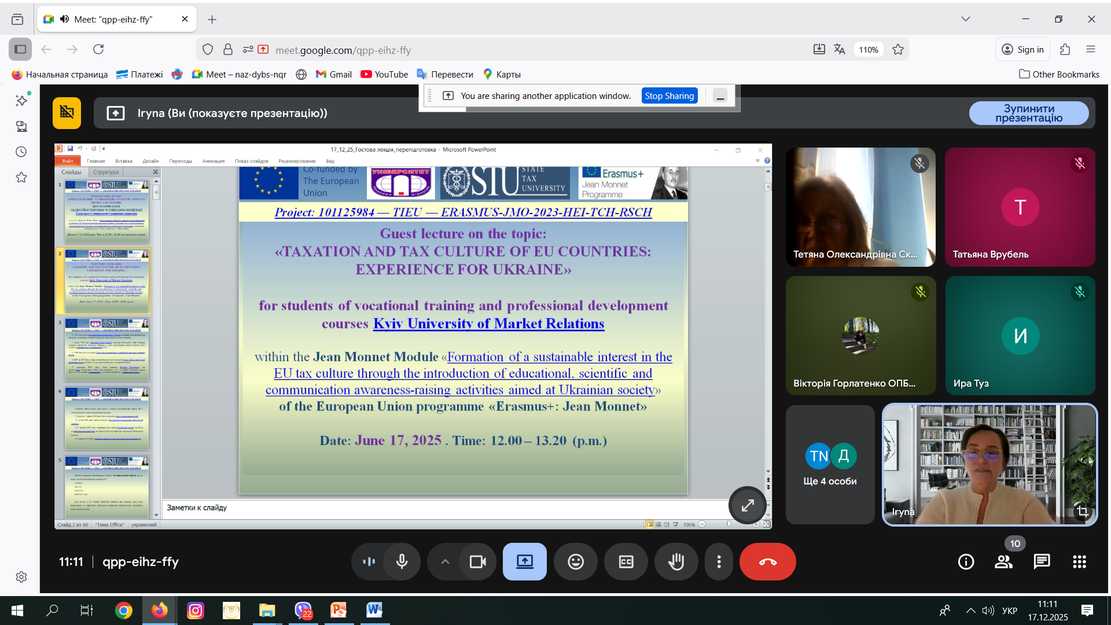

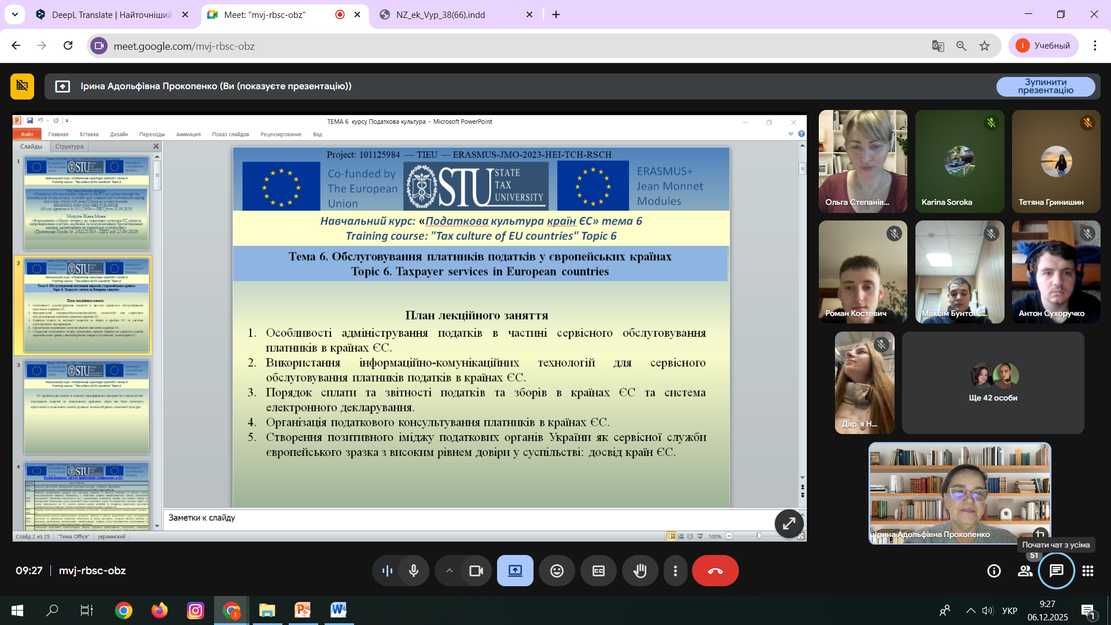

Course description EUROPEAN APPROACHES TO TAXATION AND TAX CULTURE OF EU COUNTRIES

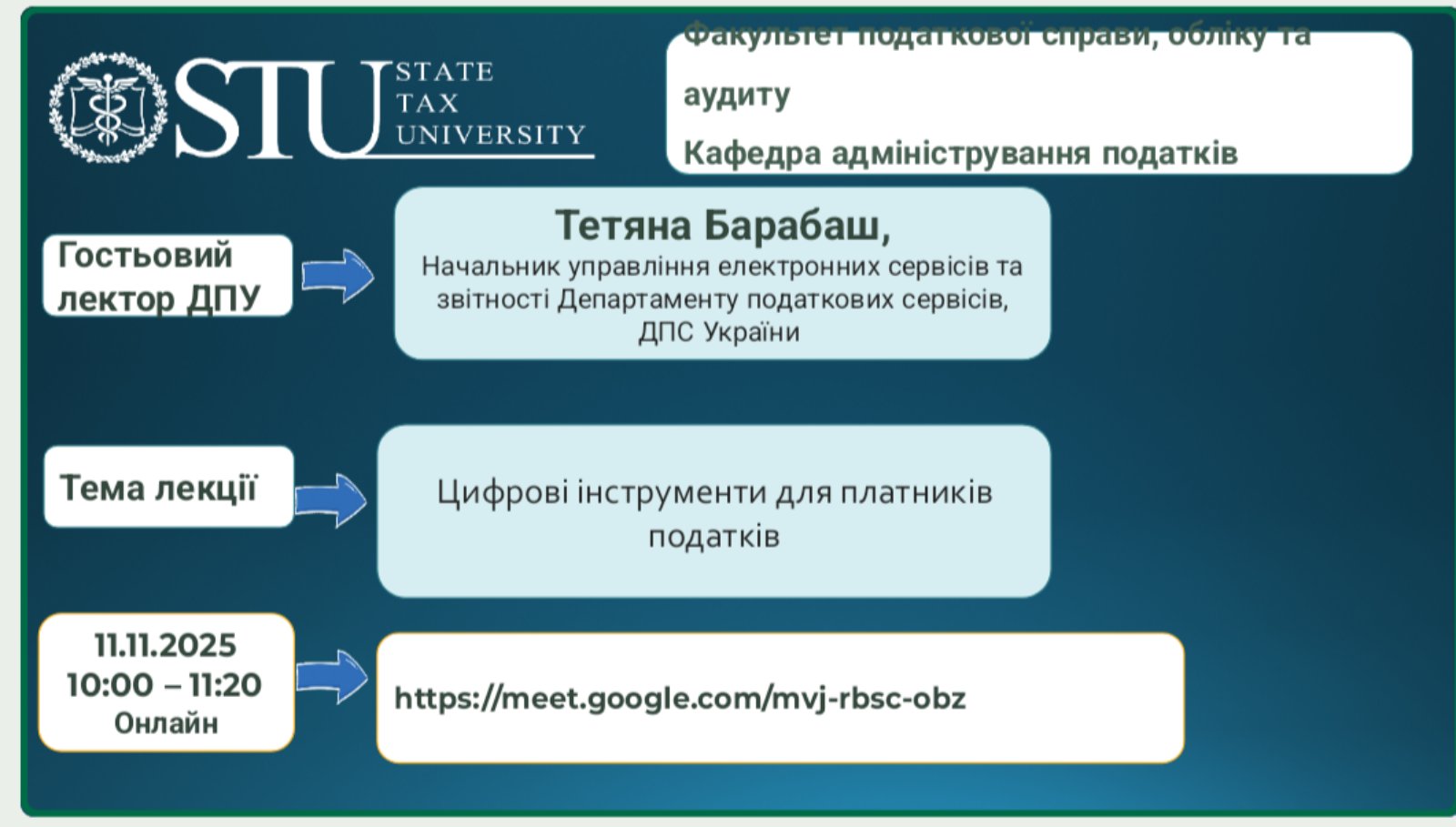

Training programme "European Approaches to Taxation and Tax Culture of EU Countries" (for employees of the State Tax Service of Ukraine and its regional offices).

The programme was approved by the decision of the meeting of the Department of Tax Administration of the Faculty of Taxation, Accounting and Audit of the State Tax University dated 28.05.2024, Minutes No. 11

The developers of the Programme are: Iryna Prokopenko and Olga Ivanyshyna - executors of the Grant Agreement № 101125984 - TIEU ERASMUS-JMO-2023-HEI-TCH-RSCH of the Jean Jean Module project.

The overall goal of the course is to develop students' theoretical knowledge and practical skills on the best traditions of taxation and ways to establish partnerships between tax authorities and taxpayers in the EU, as well as to master the forms and methods of improving the level of tax culture.

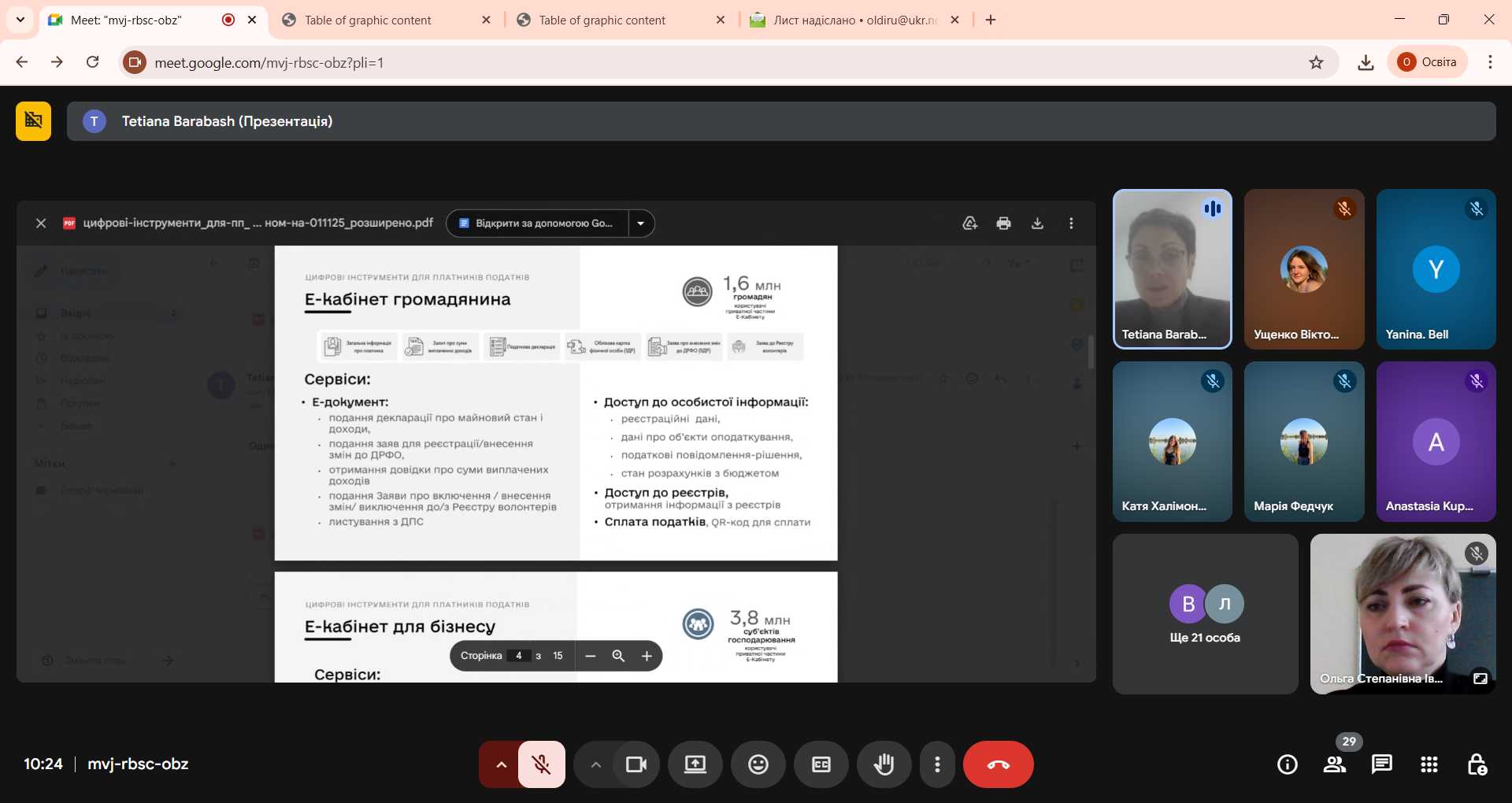

Target group: Civil servants holding civil service positions of categories "B" and "C"; local self-government officials of II-VII categories of positions; deputies of local councils and other employees of government and administration.

STRUCTURE OF THE PROGRAMME

"European Approaches to Taxation and the Tax Culture of EU Countries"*

|

Topic name: |

The number of hours: |

||

|

total number of hours/ECTS credits: |

including: |

||

|

distance education (online): |

independent work: |

||

|

Common tax policy of the EU |

3 |

2 |

1 |

|

Peculiarities of direct taxes in the EU countries |

3 |

3 |

|

|

Harmonisation of indirect taxes in the EU countries |

4 |

3 |

1 |

|

Peculiarities of the work of tax authorities in the EU countries in establishing partnerships with taxpayers |

3 |

3 |

|

|

The role and importance of tax culture in the democratisation of relations between taxpayers and public authorities |

3 |

2 |

1 |

|

Final control of learning outcomes |

1 |

1 |

- |

|

Total |

17/0,56 |

14 |

3 |

* With the financial support of the European Union. The views and opinions expressed in this publication are solely those of the author(s) and do not necessarily reflect the position of the European Union or the European Education and Culture Agency (EACEA). Neither the European Union nor EACEA can be held responsible for them.

For more information, please visit the Module's page on the website of the State Tax University at the link:https://dpu.edu.ua/kafedra-administruvannia-podatkiv?view=article&id=4008&catid=34