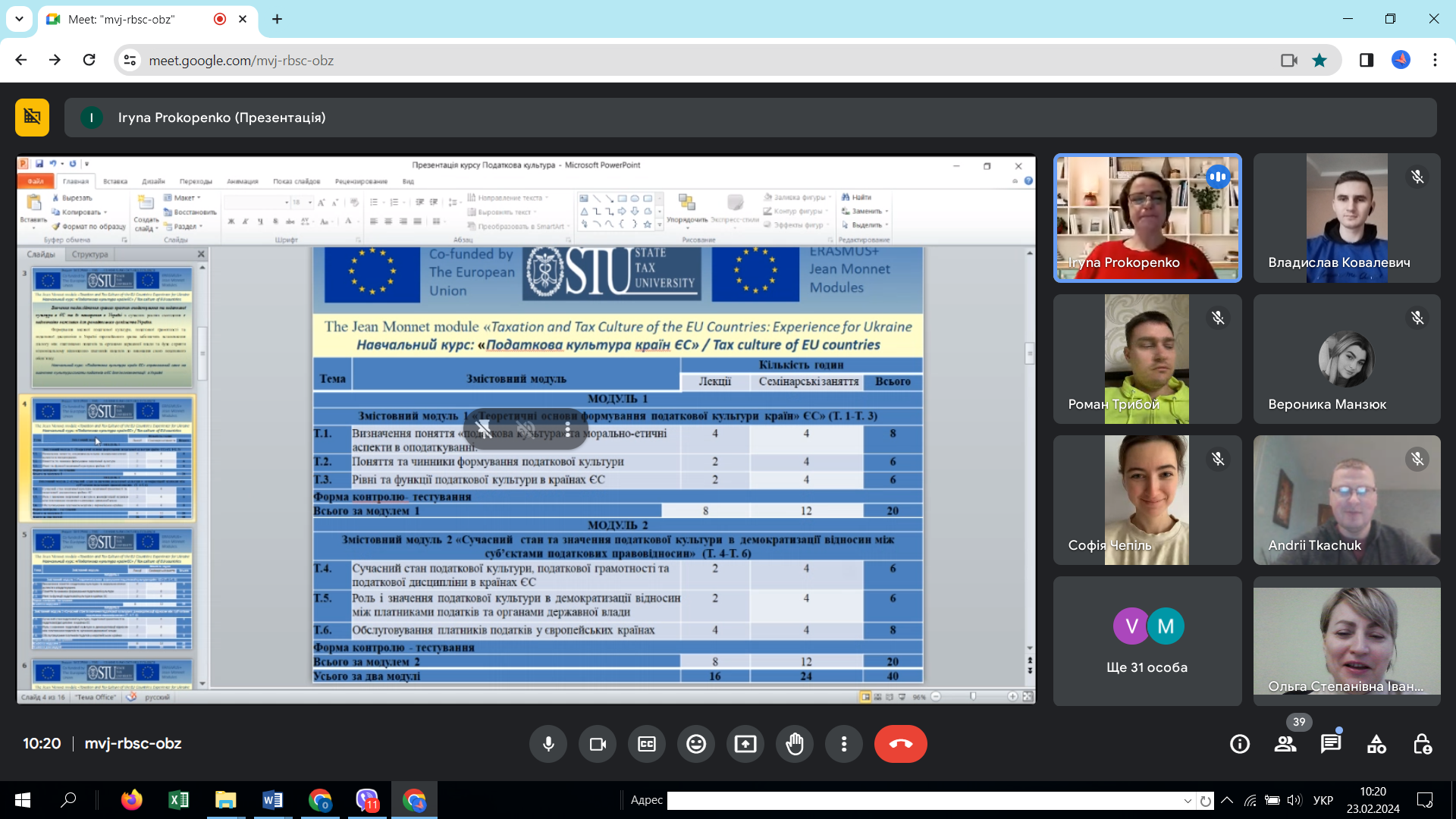

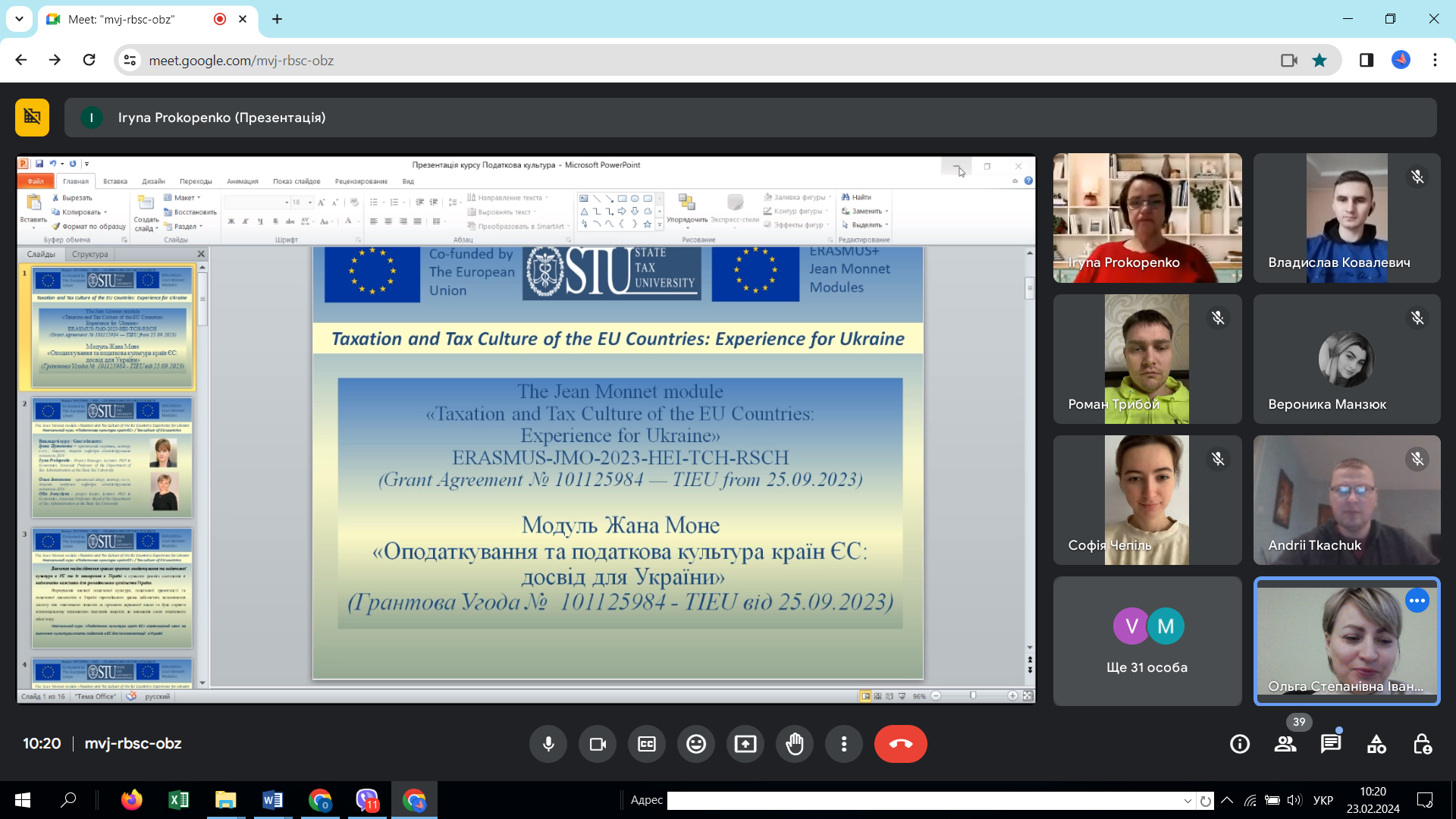

On 23.02.2024, an optional course was launched at the State Tax University: "Tax culture of the EU countries" within the framework of the Jean Monnet Module "Taxation and tax culture of the EU countries: experience for Ukraine" (Grant Agreement No. 101125984 - TIEU).

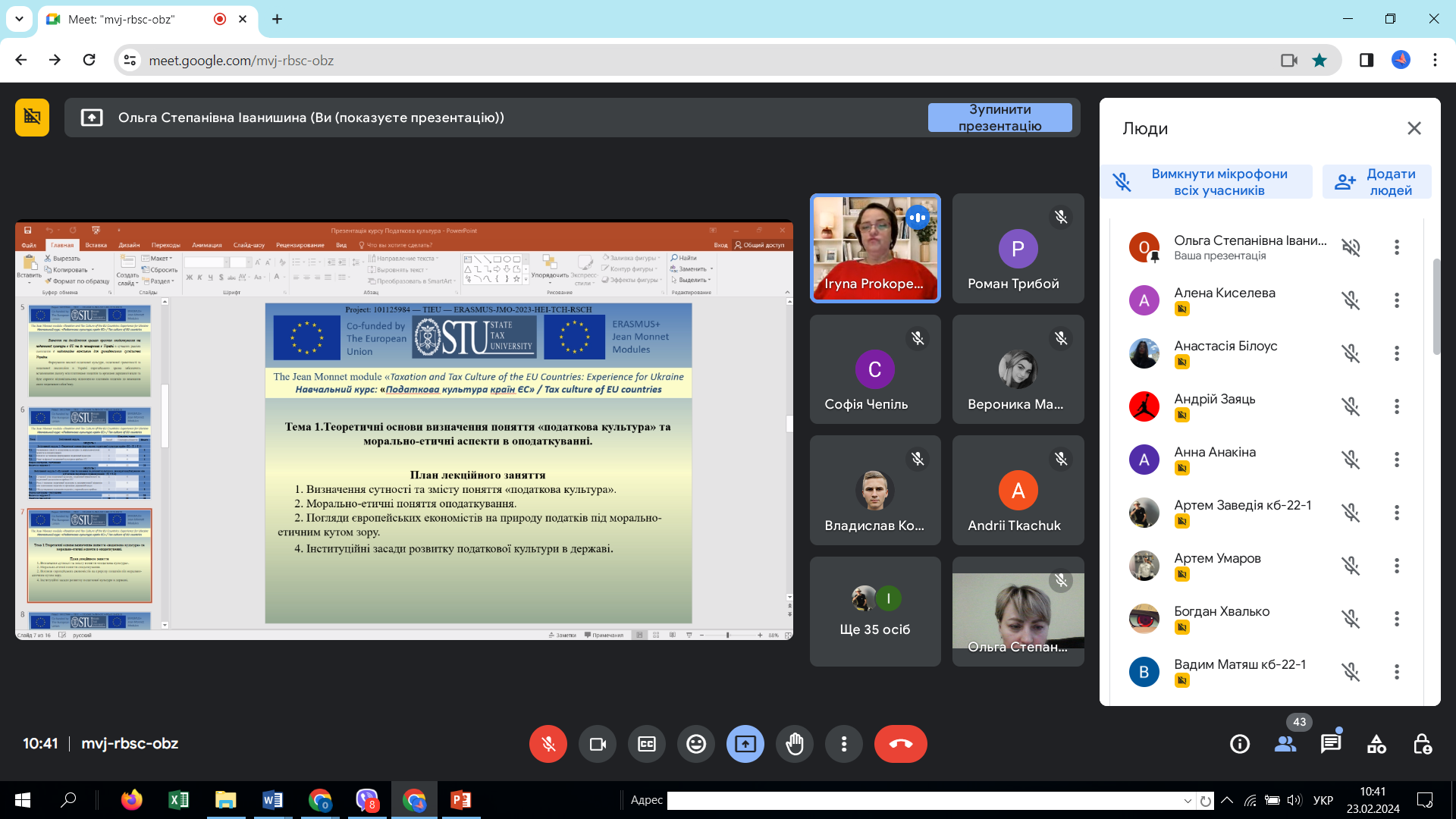

Lecturers of the Department of Tax Administration Iryna Prokopenko and Olha Ivanyshyna conducted a lecture on the topic: "Definition of the concept of "tax culture" and moral and ethical aspects in taxation"

for applicants for higher education of the first (bachelor's) level of full-time education 071 speciality "Accounting and Taxation" of the educational and professional programmes "Accounting, Business Analytics and Auditing", "Tax Consulting".

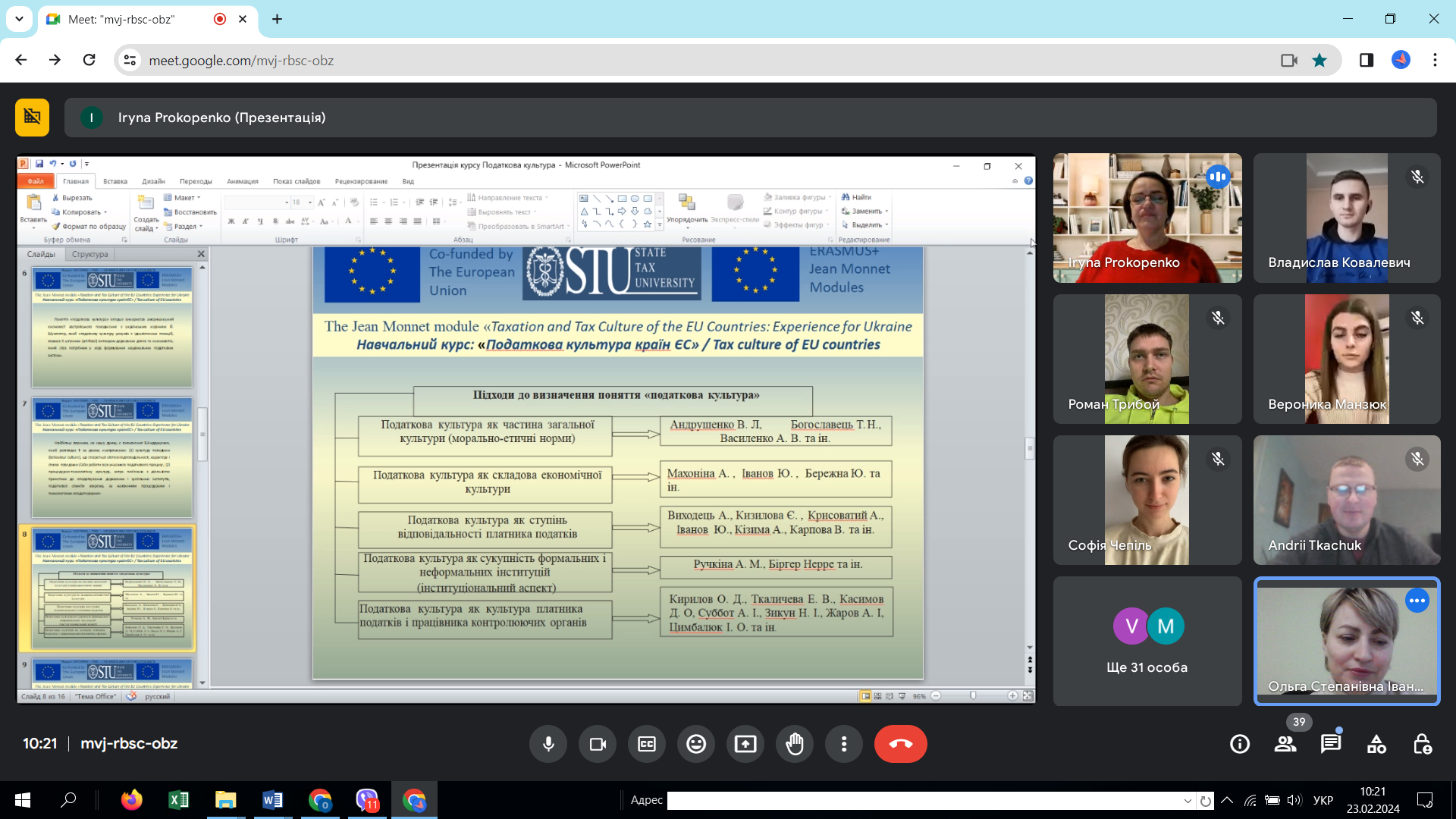

The lecturers focused on the aspects of the dependence of the development of tax culture in the EU countries on a number of factors: ethno-national peculiarities of perception of universal human values; historically determined national traditions of tax payment and the structure of the tax system; conditions of social and intellectual development of citizens; the nature of interaction between taxpayers and tax authorities.

At the end of the class, the participants discussed the impact of tax culture on the functioning of the tax system of any country and the need to improve the level of tax culture in Ukraine and to improve relations with tax authorities, taking into account the experience of EU countries.

#ERASMUS #Грантова_Угода #Jean_Monnet_Modules

#Еразмус+ #Жан_Моне

#Modul_Taxation_and_Tax_Culture_of_the_EU_Countries #Experience_for_Ukraine #Кафедра_адміністрування_податків #Оподаткування_та_податкова_культура_країн_ЄС